Explore the Best GA Hard Money Lenders for Real Estate and Investment Financing

Explore the Best GA Hard Money Lenders for Real Estate and Investment Financing

Blog Article

Everything You Need To Learn About Hard Money Lenders and Their Advantages

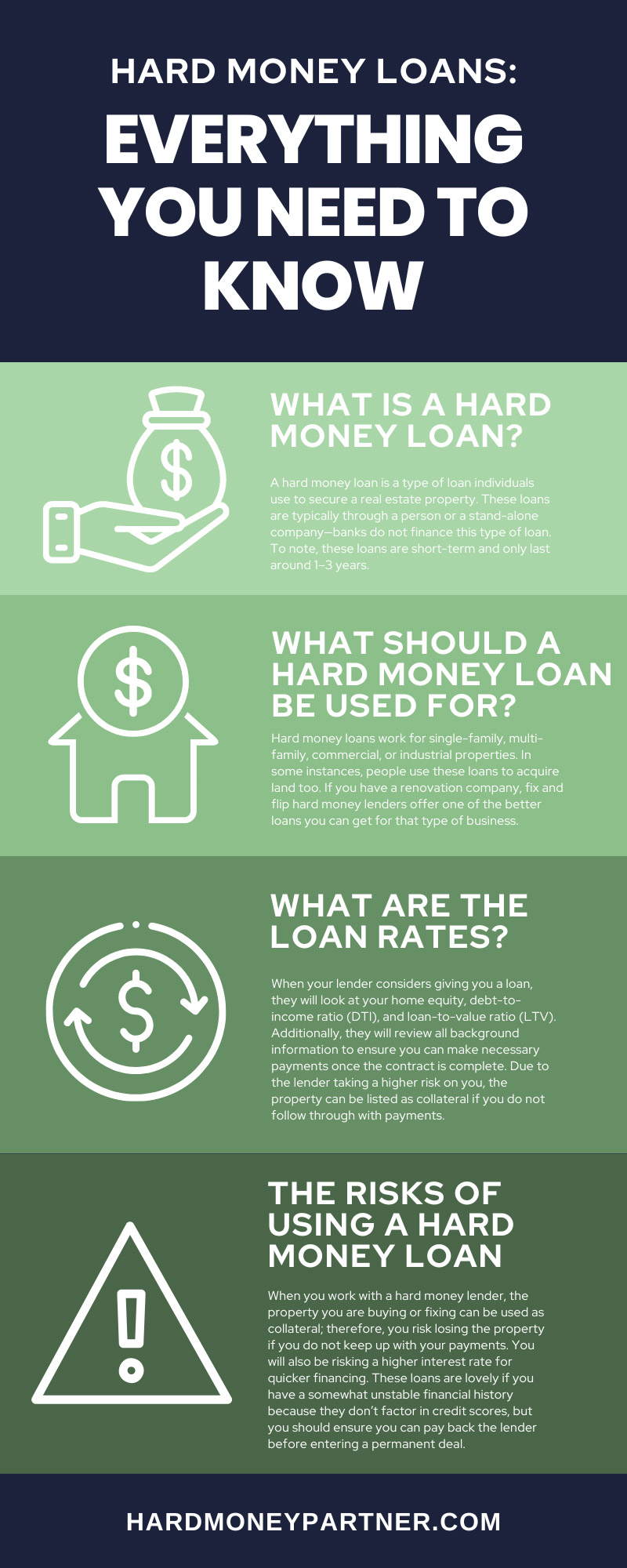

Hard money lending institutions represent a distinct funding choice, specifically for genuine estate purchases where conventional borrowing may fall brief. While the advantages of hard cash financings are noteworthy, consisting of flexibility and expedited procedures, it is important to navigate the affiliated risks attentively.

What Are Tough Money Lenders?

While conventional funding options commonly involve lengthy approval processes and strict credit score needs, tough cash loan providers provide an even more flexible alternative for borrowers seeking quick access to funding. Difficult cash lending institutions are private people or companies that provide temporary lendings safeguarded by real estate assets. Unlike conventional banks that depend greatly on the debtor's credit reliability and revenue, hard cash lending institutions concentrate primarily on the value of the collateral being supplied.

These loans are typically used genuine estate transactions, consisting of property acquisitions, remodellings, or investment opportunities. The approval procedure for difficult money finances is normally sped up, frequently causing financing within days as opposed to weeks. ga hard money lenders. This rate is especially helpful for financiers wanting to maximize time-sensitive chances in the realty market

Rate of interest on tough money car loans are typically greater than traditional financings due to the increased danger involved, yet they serve an essential function for borrowers who might not get conventional funding. Inevitably, tough cash lending institutions play a vital duty in the property investment landscape, supplying essential funding services that make it possible for borrowers to take chances swiftly and successfully.

Just How Hard Money Lending Works

Difficult money fundings are normally temporary car loans safeguarded by genuine home, mainly made use of for investment objectives. Unlike typical car loans that count heavily on credit reliability and income verification, tough cash loan providers concentrate on the worth of the collateral building.

The procedure starts when a borrower comes close to a difficult cash lending institution with a details realty project, offering information regarding the property and the meant use funds. The loan provider evaluates the property's value and condition, frequently performing an evaluation. Based upon this assessment, the lending institution figures out the loan quantity, typically varying from 60% to 75% of the residential property's after-repair value (ARV)

As soon as terms are set, including rates of interest and settlement routines, the lending is closed, and funds are paid out. Debtors are usually expected to pay back the financing in one to three years, making difficult money offering a suitable choice for those needing fast accessibility to funding for financial investments or urgent home purchases.

Key Benefits of Hard Money Loans

Difficult cash loans attract attention for their ability to supply fast access to capital, making them an eye-catching option genuine estate capitalists and programmers. Among the primary benefits of tough cash car loans is the speed of funding, typically shutting within days as opposed to weeks. This quick turn-around can be important in competitive property markets, enabling debtors to take opportunities without delay.

Additionally, difficult cash fundings are based largely on the worth of the collateral, usually genuine estate, instead than the customer's credit reliability. This makes it possible for individuals with less-than-perfect credit rating to safeguard financing. The flexibility in underwriting standards likewise enables tailored loan frameworks that can meet details project needs.

An additional considerable advantage is the potential for bigger loan quantities - ga hard money lenders. Hard cash lenders frequently provide higher loan-to-value proportions, making it possible for financiers to fund considerable tasks without requiring substantial capital gets. Hard cash visit this site car loans can be utilized for a selection of functions, consisting of property flips, improvements, or acquiring distressed properties, making them versatile tools in a financier's funding method.

Threats and Factors To Consider

Although difficult money car loans use numerous benefits, they also come with intrinsic threats and factors to consider that prospective debtors have to very carefully review. Among the key threats is the greater rates of interest associated with these lendings, which can substantially increase the general price of loaning. Borrowers may find themselves in a precarious financial situation if they stop working to repay the funding within the stipulated duration, as hard cash lending institutions normally enforce rigorous payment deadlines.

Another factor visit site to consider is the potential for foreclosure. Offered that tough cash lendings are protected by property, failing to fulfill settlement responsibilities can lead to the loss of the property. In addition, tough money lenders might not supply the very same level of regulatory oversight as standard financial organizations, which can cause predatory borrowing practices.

Additionally, while difficult money fundings can provide fast access to funding, consumers have to ensure they have a well-balanced exit technique to prevent prolonged reliance on high-interest financial debt. The lack of detailed underwriting processes can lead to over-leveraging, making it necessary for customers to examine their financial stability and project practicality prior to proceeding with a difficult cash funding.

Choosing the Right Hard Money Lender

Choosing the best hard cash lending institution is an essential step in navigating the loaning process, particularly after considering the fundamental dangers connected with these fundings. To ensure an effective loaning experience, it is vital to examine possible lenders based on their track record, experience, and terms of service.

Begin by looking into lending institutions in your location. Search for reviews and reviews, which can provide insight into their dependability and professionalism. Reputable loan providers ought to have a transparent application process and clear interaction.

Following, check out the lending institution's experience in the particular kind of home you are funding, whether domestic, commercial, or commercial. A seasoned lending institution will certainly understand the local market characteristics and possible threats connected with your task.

Finally, make certain that you feel comfortable with the lender and their team. Constructing a good relationship can help with smoother interaction throughout the lending procedure, inevitably resulting in effective task conclusion. By taking these steps, you can pick a tough cash lender that satisfies your needs efficiently.

Final Thought

In recap, difficult cash loan providers provide an alternate financing remedy that prioritizes actual estate value over customer credit reliability. Their capability to give quick financing and versatile financing frameworks makes them attractive for various property-related ventures. However, possible borrowers should remain alert pertaining to the associated risks and ensure a comprehensive leave method remains in area. Cautious selection of a dependable hard cash loan provider additionally enhances the chance of an effective loaning experience.

Report this page